Global FinTech investment in 2017 was unprecedented with $16.6B of capital (+20% compared to 2016) deployed across 1,128 deals. Despite this, some have argued that FinTech’s days are numbered and that it is less clear how much opportunity still remains for future innovation. Proponents of this line of thought argue that most traditional financial services have already been unbundled and that large startups that dominate areas like payments, lending, and investing have even begun to re-bundle services. Moreover, despite the uptick in investment into the sector, the early-stage portion of overall financing dropped to a 5-year low which has further supported the belief that most of the innovation in FinTech has already happened.

At Matrix, we believe that we are still in the early innings of the financial services disruption. While FinTech startups have done very well in the last decade, there is still room for more great companies to be built. As a follow-up to our previous article where we introduced the Matrix FinTech Index, we have put together a corollary to that piece where we specify 7 tailwinds that have powered FinTech innovation for the last 10 years, discuss key drivers for future innovation, and identify the subcategories we believe are most promising.

Review of 7 important tailwinds for innovation in FinTech the last 10 years

- Mobile has been leveraged as an enabler: Companies like Squareleveraged mobile as a way to reduce the cost of doing business for merchants by allowing for new features like secure payments via mobile applications.

- The financial crisis created unmet demand: Incumbent’s unwillingness to lend to credit poor individuals and high-risk SMBs created a window of opportunity for companies like Lending Club and OnDeck to fulfill this unmet demand.

- The payments infrastructure opened up to developers: APIs and developer tools made available by companies like Braintree and Stripeallowed developers to integrate payment processing into their websites without the need to maintain a merchant account.

- Online banking penetration unlocked important customer data: Deeper penetration of online banking has made it possible for companies like Yodlee to allow users to see all their banking information on one screen and others like Credit Karma to provide credit monitoring services.

- Core financial services have been unbundled: Many sub-segments traditionally handled solely by the banks have been unbundled. For example, SoFi is helping with borrowing, Xoom with money transfers and Mint with financial management.

- The cloud provided a new distribution channel to serve SMBs: Companies like Kabbage, which provides loans to SMBs, can now justify serving lower life time value customers like SMBs due to the lower customer acquisition costs associated with the cloud.

- Digital disintermediation provided greater value to consumers: Companies like Wealthfront, Betterment and Robinhood all reduce the fees charged by brokerages and traditional investment managers providing greater alpha to retail investors.

Key drivers for innovation in the next 10 years

Many of these 7 trends will continue to play a role in FinTech innovation moving forward. But we have identified 3 additional drivers for innovation in FinTech going forward.

1. Incumbent failures are really coming into focus.

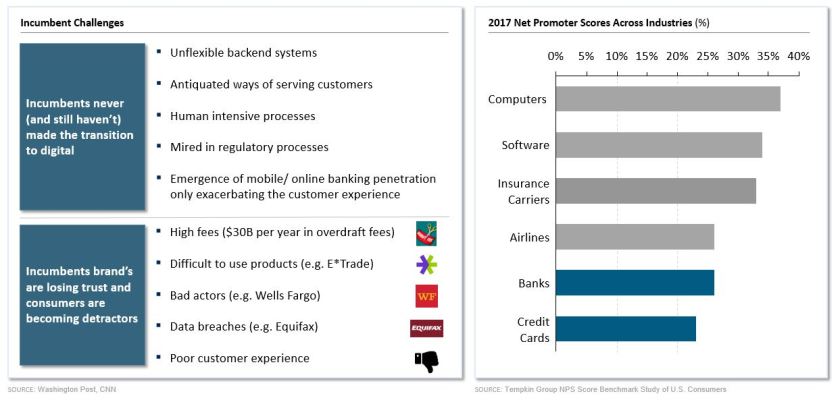

Traditional financial institutions are anachronistic. They serve their customers with antiquated products and are often slow to innovate due to both their size and regulatory burdens. Moreover, financial products have historically not been customer-centric, as banks devote most of their resources to optimizing their data and analysis and boosting their bottom line. Consequently, incumbents in financial services have largely failed to meet the needs of consumers, and the emergence of FinTech has put their shortcomings under the spotlight.

While financial services as an industry has been notorious for low consumer trust levels, consumer trust has plunged even further in the wake of fraud, scandals, and data breaches (e.g. Wells Fargo and Equifax). Additionally, poor customer experience has left consumers with limited loyalty to their financial services providers.

2. Millennials are emerging as the new source of spending power.

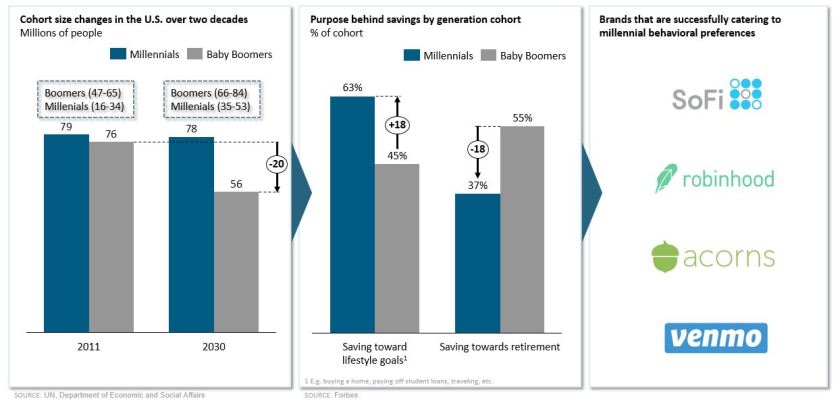

Millennials are the largest generation in American history consisting of over 70 million people born between 1980 and 2000. Millennials are digital-first users who grew up distrustful of banks and are generally more inclined to try FinTech applications. Furthermore, while traditional financial services has focused on large pools of wealth characteristic of older generations, FinTech innovation is making financial services and products much more accessible to younger generations.

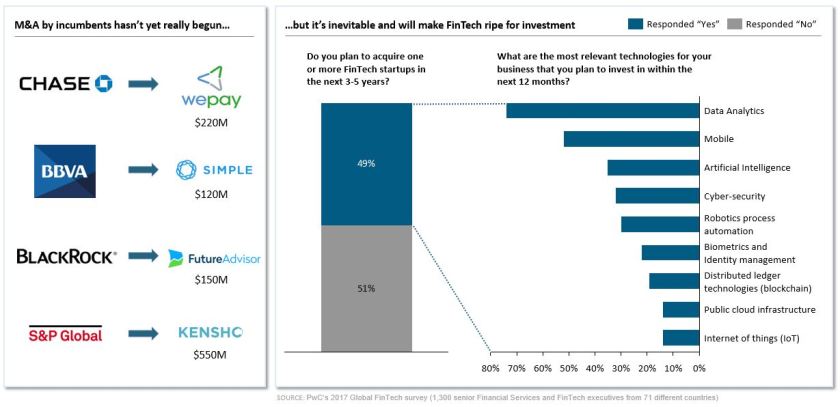

3. Due to the transition of profit pools, incumbents are going to become a lot more acquisitive in the coming months.

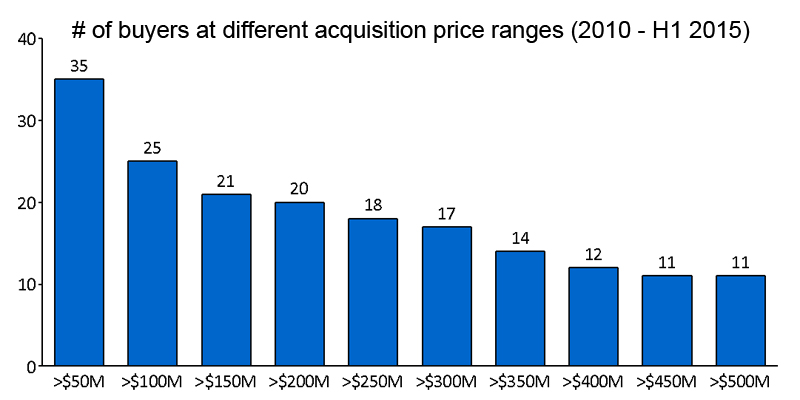

Incumbents have begun to acquire FinTech companies as a means to compete against innovative startups and other acquisitive incumbents. Many of the acquisitions so far have been centered around automation of basic tasks. In the last 5 years, 18 FinTech startups have been acquired by banks, with 8 acquisitions occurring since the beginning of 2017. We believe that there is much more opportunity and incentive to acquire — especially for technologies that go beyond automation.

5 subcategories we are most excited about

Ultimately we believe the incumbents will continue to lose ground to the FinTechs and that there is plenty of opportunity for entrepreneurs to build enduring companies in the sector. Great companies will certainly be built across the entire financial services industry, but here are a few sub-categories within FinTech that we think are particularly exciting:

- Payments: Even with all the innovation to date in payments, there continue to be pain points throughout the category and many customer demographics remain underserved. In order to be successful in this category, new entrants will need to build on-top of existing payment rails, serve large TAMs and go after new use cases.

- Investing / wealth management: Despite recent innovation by players like Wealthfront, Betterment, Robinhood and others, wealth management remains dominated by the incumbents. This reality makes the category a ripe one for entrepreneurs as there are large TAMs, poor customer experiences and a new generation (i.e. millennials) that have unmet needs. Success here will require intuitive design, low fees and efficient customer acquisition.

- Infrastructure Apps: Financial institutions suffer from bloated cost structures in the middle and back office for tasks like fraud/ risk management, collections, invoice management and customer support. There’s an opportunity for entrepreneurs to provide software tools that reduce costs and allow for more efficient work flows if they can manage the lengthy sales cycles and procurement processes.

- SMB tools: Companies like Gusto and Namely, have begun to serve SMBs in areas like payroll and benefits administration. Even so, SMBs remain largely underserved compared to larger enterprises. FinTech companies that can acquire SMBs efficiently and provide enterprise-level experiences will be able to generate enough value to their customers to create large outcomes.

- B2B Lending tools: On the consumer side, lending has become pretty crowded with some of the winners already declared. But on the enterprise side, the category is very ripe. The opportunity for entrepreneurs is in leveraging data at cloud scale combined with advances in machine learning to allow enterprises to better assess borrower risk and drive higher yield.

The author would like to thank Sreyas Misra for his contributions to this piece.

Source: EdSurge

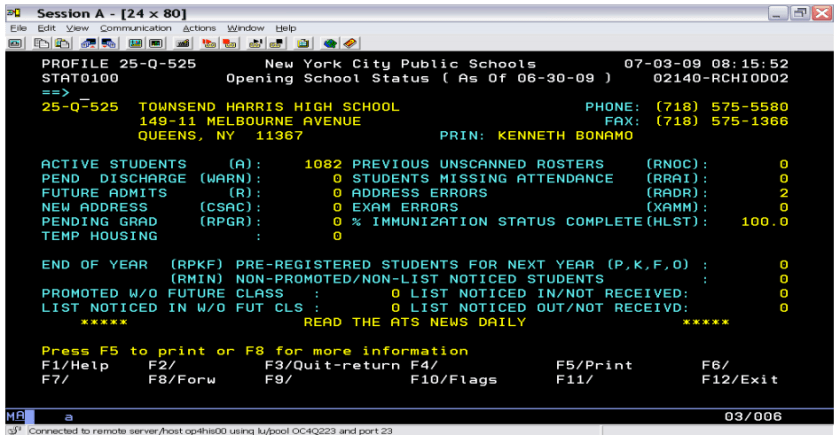

Source: EdSurge Source: NYC Department of Education

Source: NYC Department of Education